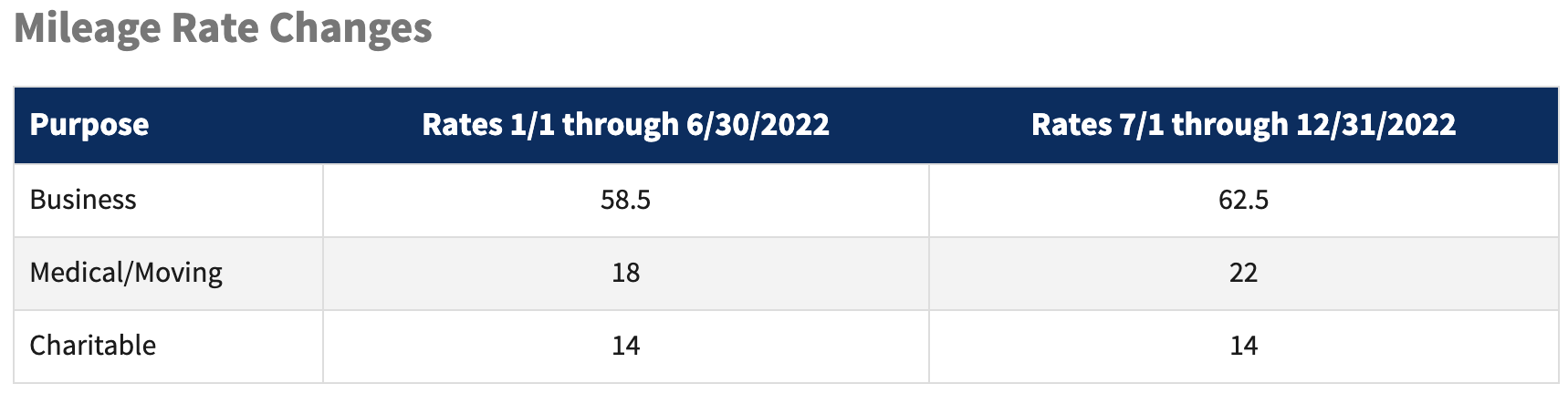

In recognition of recent gasoline price increases, the IRS has increased the standard mileage rate for the final 6 months of 2022. The standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. The new rate for deductible medical or moving expenses will be 22 cents, up 4 cents from the rate effective at the start of the year. The new rates become effective July 1, 2022. The 14 cents per mile rate related to charitable organizations remains unchanged. Note, taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates set by the IRS.